At a glance

In September 2023, CDC released its first-ever respiratory disease season outlook. For this evaluation, we assessed how the outlook's hypothetical scenarios for combined peak hospital burden compared to observed data. We found the outlook provided useful ranges to help inform long-term planning for public health decision-makers and planners.

What was our assessment for the 2023-2024 season?

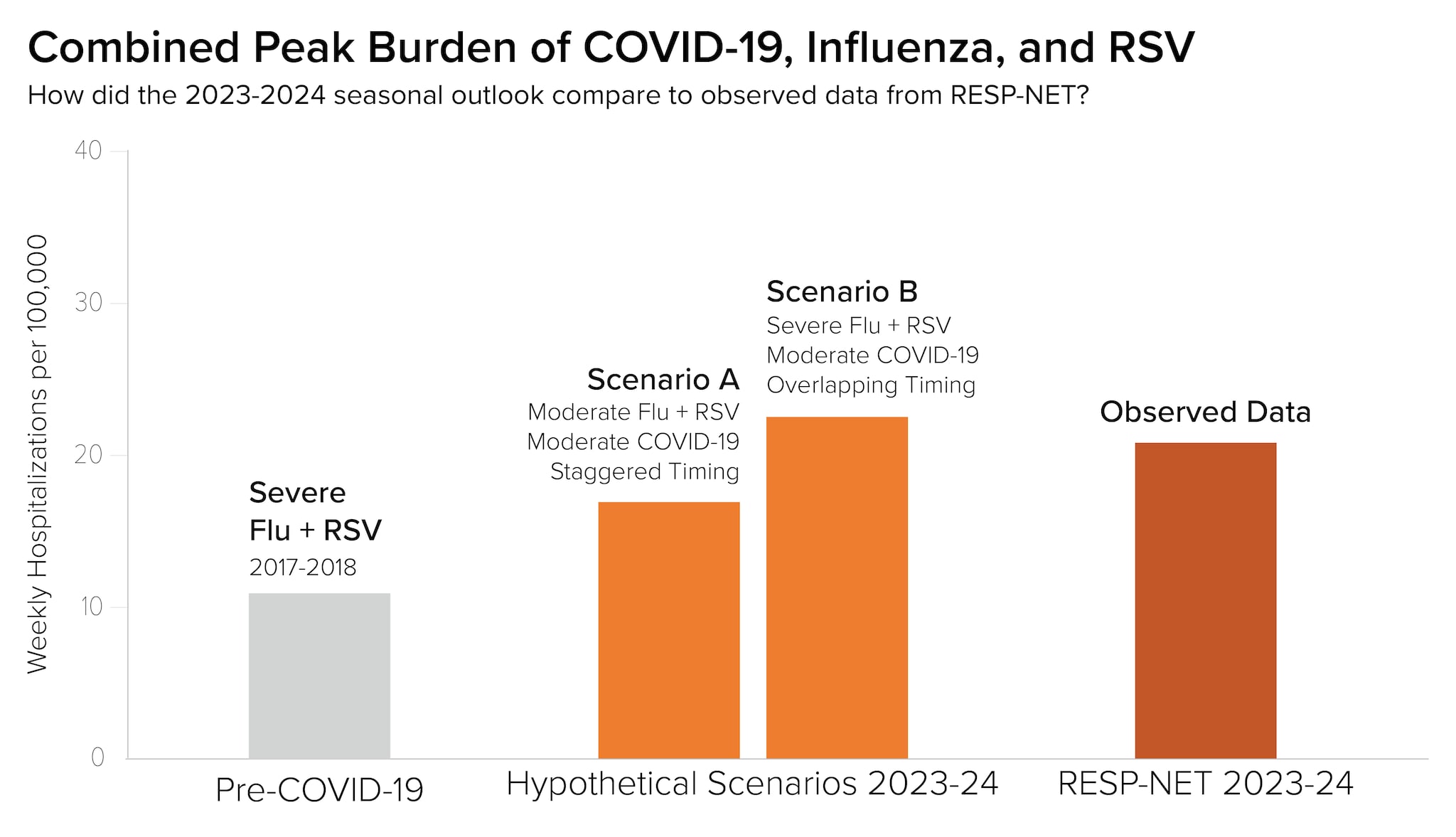

Last season, CDC released its first-ever respiratory disease season outlook to provide decision-makers with information to assist in public health preparedness for major respiratory virus illnesses. In our September 2023 assessment, we estimated the 2023-2024 respiratory virus season would likely have a similar number of total hospitalizations as the 2022-2023 season. We also considered peak hospitalization burden and developed two hypothetical scenarios for the combined peak burden of COVID-19, influenza, and RSV:

- Scenario A: For this scenario, the combined respiratory peak hospitalization rate would be roughly 20% lower than the 2022-2023 peak. We developed the scenario by combining historical disease data for a moderate COVID-19 wave (winter 2022-23) with historical data for a moderate influenza peak (2019-2020) and the RSV rate during the same week in that season (2019-2020). We also shifted the timing of the COVID-19 wave so that the peak would occur three weeks prior to the peak of influenza and RSV hospitalizations, resulting in staggered timing of disease peaks.

- Scenario B: For this scenario, the combined peak hospitalization rate would be similar to the 2022-2023 season peak, and slightly higher than the peak for COVID-19 alone in winter 2020-2021. We developed the scenario by combining historical disease data for a moderate COVID-19 wave (winter 2022-2023) and historical data for a high-severity influenza peak (2017-2018) and RSV data from the same week in that season (2017-18). We also shifted the timing of the COVID-19 wave so its peak would occur in the same week as influenza and RSV peak hospitalizations, resulting in overlapping disease peaks.

While we updated the outlook four times throughout the respiratory season, our overall assessment remained unchanged. Our confidence in this assessment increased as the season progressed.

How did our assessment compare to observed data?

We note that our long-range outlook was intended to offer potential scenarios for how the season would unfold and was not intended as a prediction or a forecast. However, we compared the outlook to observed data to evaluate how well our assessment captured overall trends, and to consider improvements for future seasonal outlooks.

For this evaluation, we assessed how our hypothetical scenarios for combined peak hospital burden compared to combined peak burden using data from the Respiratory Virus Hospitalization Surveillance Network (RESP-NET)A. RESP-NET conducts population-based surveillance for laboratory-confirmed hospitalizations associated with COVID-19, influenza, and RSV.

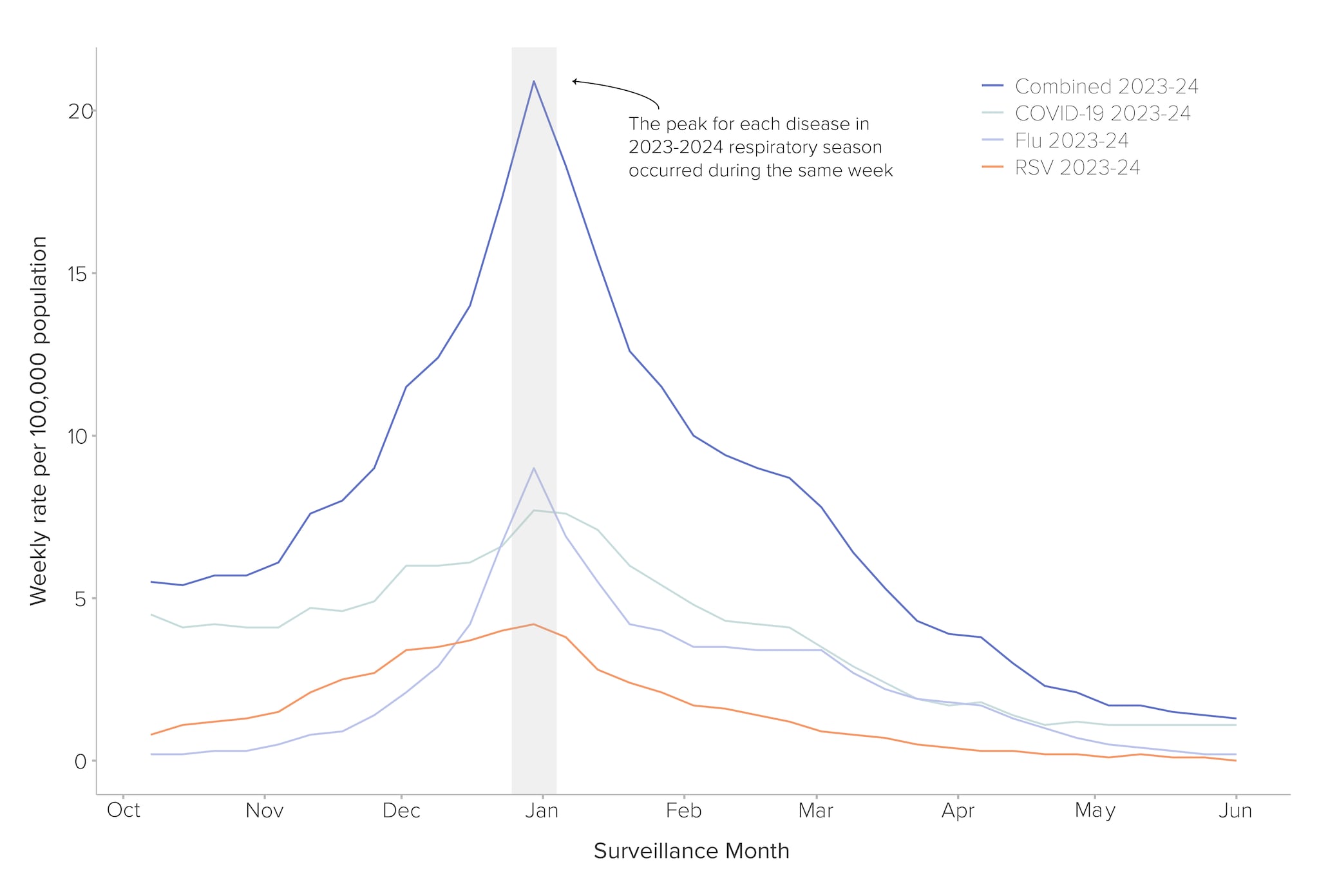

Since the combined 2023-2024 hospitalization peak fell between Scenario A and Scenario B, we conclude that our hypothetical scenarios and assessment provided useful ranges to help inform long-term planning for the 2023-2024 season (Figure 1). The season aligned most closely with Scenario B, partly because we observed overlapping peak burden for COVID-19, influenza, and RSV (Figure 2).

Below, we outline how the observed 2023-2024 peak hospitalization burden compared to our hypothetical scenarios by disease:

- COVID-19: The peak hospitalization burden from COVID-19 during the 2023-2024 season was 7.7 weekly hospitalizations per 100,000—lower than the 2022-2023 season rate of 10.9 hospitalizations per 100,000, which we used to define the moderate COVID-19 peak for hypothetical scenario BB. The introduction and predominance of the JN.1 variant likely drove the COVID-19 wave during this period, although the wave was smaller than past winter waves.

- Influenza: The peak hospitalization burden from influenza during the 2023-2024 season was 9.0 weekly hospitalizations per 100,000—substantially higher than the 2019-20 season rate of 6.0 hospitalizations per 100,000, which we used to define a moderate-severity influenza peak in Scenario A, but lower than the 2017-2018 influenza season peak of 10.2 hospitalizations per 100,000, which we used to define a high-severity influenza peak in Scenario B.

- RSV: The peak hospitalization burden due to RSV during the 2023-2024 season was 4.2 hospitalizations per 100,000—higher than both the 2019-2020 and the 2017-2018 season rates for Scenarios A and B.

To evaluate our assessment that the 2023-2024 season would have a similar number of total hospitalizations compared to the previous season, we compared the combined 2023-2024 cumulative hospitalization rate for COVID-19, influenza and RSV to that of the 2022-2023 season, using RESP-NET cumulative hospitalization rates. The combined cumulative hospitalization for the 2023-2024 season was 264.3 per 100,000 (week ending 5/04/2024C), 14.2% lower than the rate of 308.1 per 100,000 during the 2022-2023 season (week ending 5/6/2023C). We believe our outlook provided a reasonably accurate assessment for a long-range outlook, given the difference between these rates was under 20%.

What does this mean for next season’s outlook?

Our first respiratory disease season outlook provided useful ranges to help inform long-term planning for public health decision-makers and planners. We plan to evaluate potential additional activities to help inform the outlook in the coming season, which we are intending to publish in late August.

- RESP-NET covers roughly 8–10% of the U.S. population in select counties from 12–14 states. Data limitations related to active surveillance networks exist, including variability in ascertainment of data year-to-year, underestimation of hospitalization rates due to undertesting and underreporting of cases, differing testing practices across healthcare providers, and differences in diagnostic test sensitivity. Additionally, the most recent data available is preliminary and subject to change; rates are updated as new data is received.

- For Scenario A, in order to account for staggered timing, we used the hospitalization rate 3 weeks prior to the peak during the 2022-2023 COVID-19 wave, which was 9.4 hospitalizations per 100,000.

- Data accessed on 8/1/2024