What to know

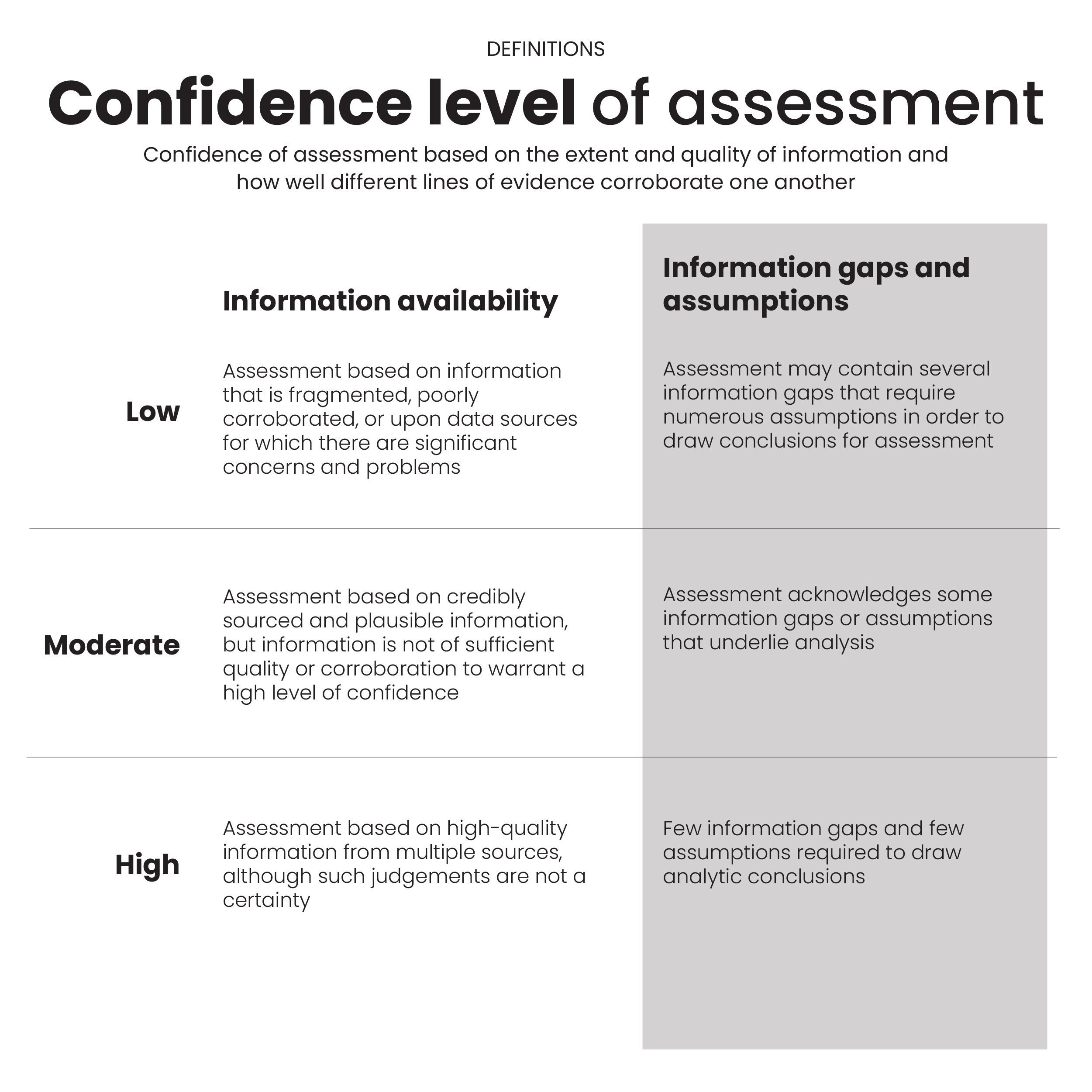

- CFA uses confidence levels to assess certainty in our work based on the extent and quality of information available and how well different lines of evidence corroborate one another.

- Confidence levels are defined in three levels: low, moderate, and high.

What are confidence levels?

CFA uses confidence levels as a way to assess certainty in our work based on the extent and quality of information available and how well different lines of evidence corroborate one another. These confidence levels incorporate the entire body of evidence in our risk assessments and scenario assessments and are different from how we assign uncertainty in our expert elicitation process, which only takes into account individual uncertainty when assessing expert judgment.